GOING SOLAR

Your system can pay for itself in just a few short years.

Your electricity bills are too high…and electricity gets more expensive every year. You’ve been at the mercy of your utility company with no choice other than to use less energy or pay more. Plus, energy made by the utility companies comes at an even higher cost — our planet and our health. Residential solar installation in New Jersey is a great way to protect your wallet and the environment.

How Solar Works

Although they may look complicated, solar panels have no moving parts and require very little maintenance, other than occasional cleaning. An inverter takes the DC power directly from the solar panels and converts it to the same AC power that your home uses. There is no need to change your appliances. Solar is a great solution to ever-rising costs of energy and to keep our community and planet healthy.

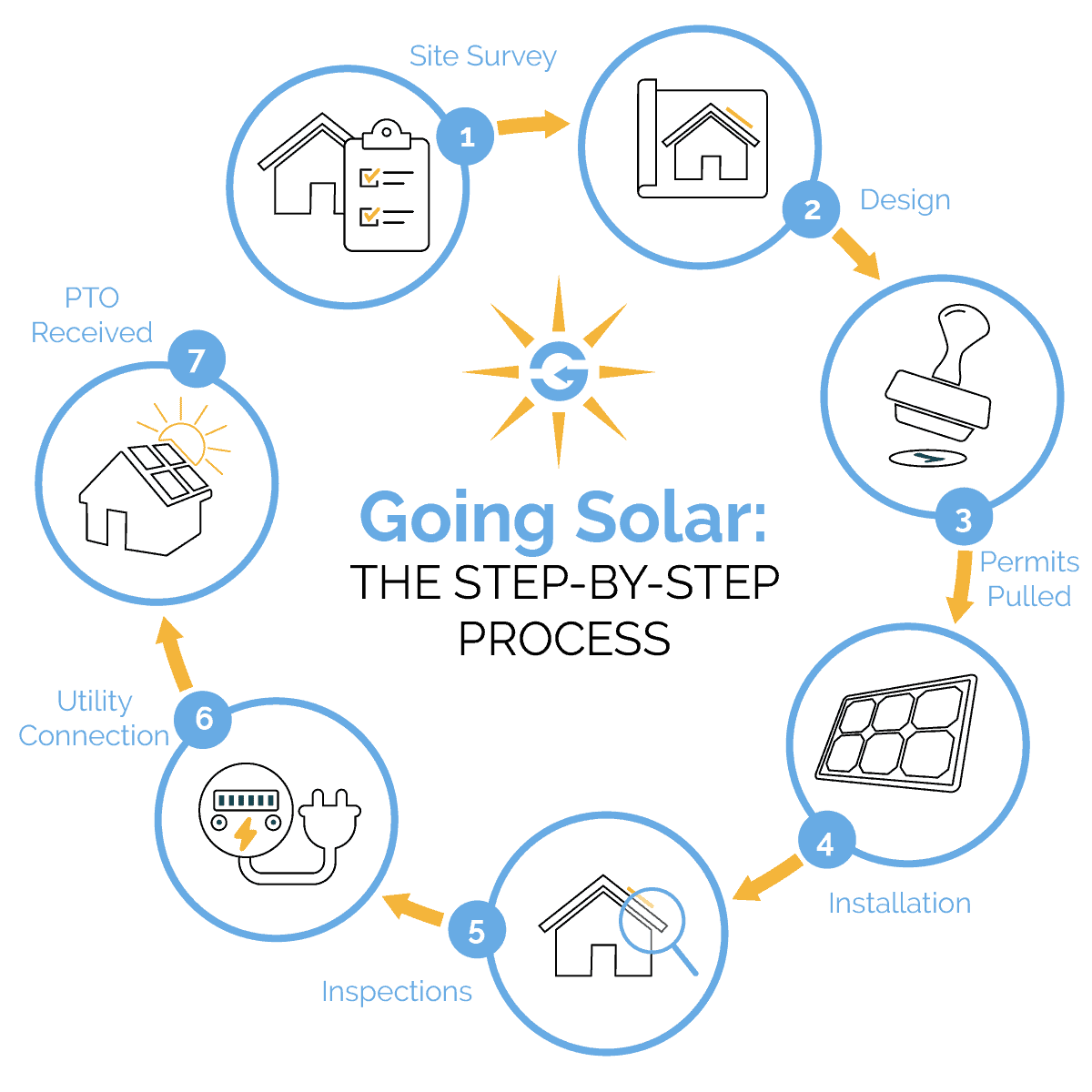

Easy Going Solar Steps

- Site Survey: Site visit, shading analysis, and system design by a Professional Installer.

- Design: The system design includes the location of the solar array, inverter, AC & DC disconnects, meter, and electric panel boxes.

- Permits Pulled: Applications for permits, utility, HOA, and other agencies are completed and filed to collect necessary permits and potential incentives.

- Installation: The system is then installed and quality checks are completed.

- Inspections: The city will then inspect the installation.

- Utility Connection: Upon their approval, the utility company also completes their review of the system and installation.

- Permission To Operate (PTO): Final testing is completed to ensure your system is operating properly and it is officially turned on.

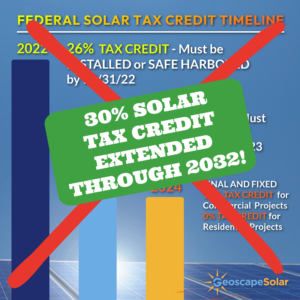

30% Federal Tax Credit

The Federal Investment Tax Credit (ITC), also known as the Federal Solar Tax Credit, allows you to deduct 30% of the cost of installing a solar energy system from your federal taxes. This credit was extended through 2034 with the passage of the Inflation Reduction Act.

$0 Down Solar Financing

Zero Down Solar Financing for solar depends on your lifestyle, taxable income, personal preference, and your desired savings. Geoscape Solar will work to find the financial solution for you. Whether it is a cash purchase, a financed purchase, or a lease, we have the right type of funding to best suit your needs.

Unsecured Solar Loans

- No money out of pocket in most cases

- Short and long term options to fit your budget

- Low interest rates

- You receive all government incentives

- Let your solar savings make your loan payments

Solar Monthly Lease

- No money out of pocket

- Savings start in your first month

- Low monthly payments

- Save up to 40% on your electric costs

- Includes monitoring, repairs, and insurance

- Includes production guarantee

Geoscape Solar EasyOwn Lease™

- NO monthly lease payments

- Single upfront payment

- Save 15% or more off the purchase price

- You keep all Transitional Renewable Energy Certificates (TRECs)

Solar Home Equity Loan

- Use the equity in your home to invest in solar

- Use up to 90% of the home value to secure a loan with 5 or 10 year options

- Loans have low interest rates and a fixed payment schedule

- You receive all government incentives

- You own your system after the term of the loan

Everyone’s financial condition is different, so we never use a “cookie cutter” solution. We work with you to take advantage of all the available incentives and our financial connections to offer the broadest array of financing options.

Geoscape Solar Complete Confidence Warranties

No matter what products your system includes, rest assured they’re the best available.

Complete System

Our manufacturer warranties ensure both the product quality and the highest power production available. If you experience issues with your system within 25 years of purchase, our technology partners will replace, repair, or reimburse you — hassle free.

Complete Service – Covers 100% of repair or replacement costs

It’s the best warranty you may never have to use. But if you do, we make it simple and quick. Labor, shipping, parts — we take care of everything.

- 25-years – Panels, Microinverters, Racking, and Power production

- 10-years – Monitoring hardware

QUICK LINKS

Use the links below for more information.

LET’S CONNECT

Get a complimentary solar analysis for your property.