Tax policies, specifically the 30% Solar Investment Tax Credit (ITC), have long existed as a key financial driver of the solar industry. The Solar ITC is a one-time dollar for dollar tax credit that is 30% the cost of installing a solar energy system. However, the non-profit sector of the economy was left out of both the cost savings potential and the environmental benefits of switching to solar energy. For non-profit properties, including government organizations and houses of worship that don’t pay taxes, a tax credit is meaningless to their balance sheets.

The Inflation Reduction Act (IRA), addressed this issue by creating a system of direct cash payment of any potential non-profits who convert to solar energy. The IRA requires the Internal Revenue Service (IRS) to make an equal direct cash payment to any qualifying tax exempt nonprofit organization that completes a solar project. This allows non-profits to realize similar cost savings and a return on investment (ROI) from a solar energy installation that for-profit entities enjoy: reduced operating costs, investment in their properties, and production of clean energy.

Do all Non-Profit Organizations Qualify for the 30% Direct Payback Program?

The non-profit organization or applicant must own the non-profit property where the commercial solar energy system is being installed. Additionally, the non-profit must be tax-exempt under 501(a) of the federal tax code to qualify for the solar energy direct payback program. This includes non-profits created under 501(c) of the tax code. This also includes religious institutions that are tax-exempt under 501(d) of the tax code. Non-profits created under state-law that are not federally tax-exempt do not qualify.

What about Solar Energy Bonus Credits?

If the solar energy system size is under 1megawatt (MW), the non-profit organization or applicant will be allowed to apply for both the 30% ITC as well as bonus incentives as detailed in the Inflation Reduction Act. These include solar energy credits in low-income areas, community solar energy, and a 10% domestic content bonus for installing solar energy components produced domestically.

What is the 2024 Domestic Product Content Requirement?

Any solar energy project that begins construction in 2024 must meet the domestic production requirements in order to receive the full 30% Direct Pay. Organizations whose projects do not meet these requirements will only receive 90% of the overall amount of the solar energy credit they would otherwise qualify for. If construction begins in 2025, the amount drops to 85%. Solar energy projects that begin in 2026 or later will not receive any direct pay if the domestic content requirements are not met.

Long Term Impact of Solar Energy for Non-Profit Organizations

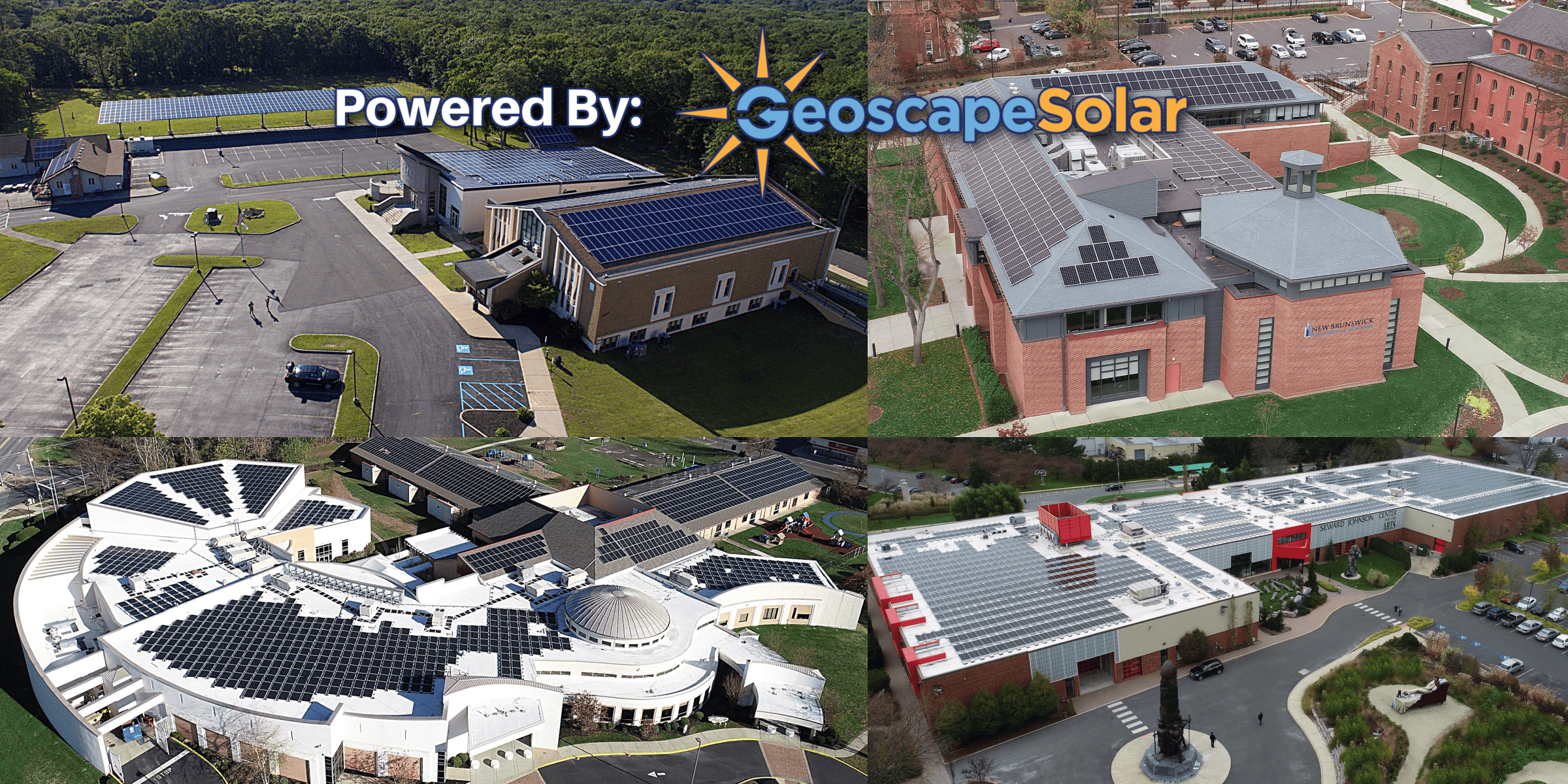

After the passage of the IRA, the demand for solar energy for non-profit organizations in New Jersey has increased dramatically. Receiving a payment of 30% (or more) of the cost of a non-profit solar installation yields a lucrative investment that solves the constant need to reduce operating expenses. Solar energy also frequently aligns with organizations’ mission to protect the planet and reach their sustainability goals.

Is Commercial Solar Energy right for your non-profit organization? Click Here to take our 1 minute solar quiz and find out!

Geoscape Solar has partnered with multiple non-profit organizations and helped lower their operating costs by converting to solar energy. With a 15 year track record of delivering high quality non-profit solar energy projects and exceptional customer care, Geoscape Solar is a trusted non-profit solar provider in the New Jersey energy market. Contact us at 1.877.GEO.SUN.1 to schedule a complimentary phone consultation.