Climate change’s impact is more pronounced than ever, but since the passing Inflation Reduction Act, new financial incentives have make commercial solar energy more financially accessible to farmers and property owners in less populated areas. This historic bill provided for increased and expanded incentives for businesses located in rural parts of the country as well as bringing the Federal Solar Tax Credit back up to 30% of the total cost of a solar installation.

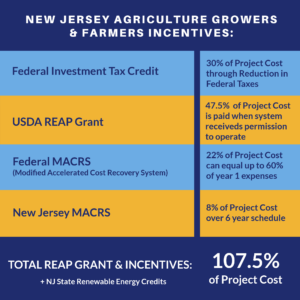

In 2024, eligible farmland can save up to 100% of project costs of transitioning to solar energy by taking advantage of federal grants and state incentives. By embracing commercial solar power, farms are protected from unpredictable rate hikes and bolster their financial health by moving towards energy self-sufficiency and responsible operations. These incentives include The Federal Investment Tax Credit, Rural Energy for America Program, Federal Modified Accelerated Cost Recovery System, and State Modified Accelerated Cost Recovery System.

FEDERAL INVESTMENT TAX CREDIT = UP TO 30%

With the passage of the Inflation Reduction Act, the Federal Investment Tax Credit (ITC) for solar was raised from 22% to 30%. The ITC allows property owners to deduct a dollar for dollar tax credit of up to 30% of the cost of installing a commercial solar energy system on their taxes. This is typically taken in the same tax year that the solar energy system is installed. However, you can continue to roll over unused portions of the credit for as long as the solar tax credit is in effect. Currently, the 30% solar tax credit in effect until 2032. It will drop to 26% in 2033 and to 22% in 2034.

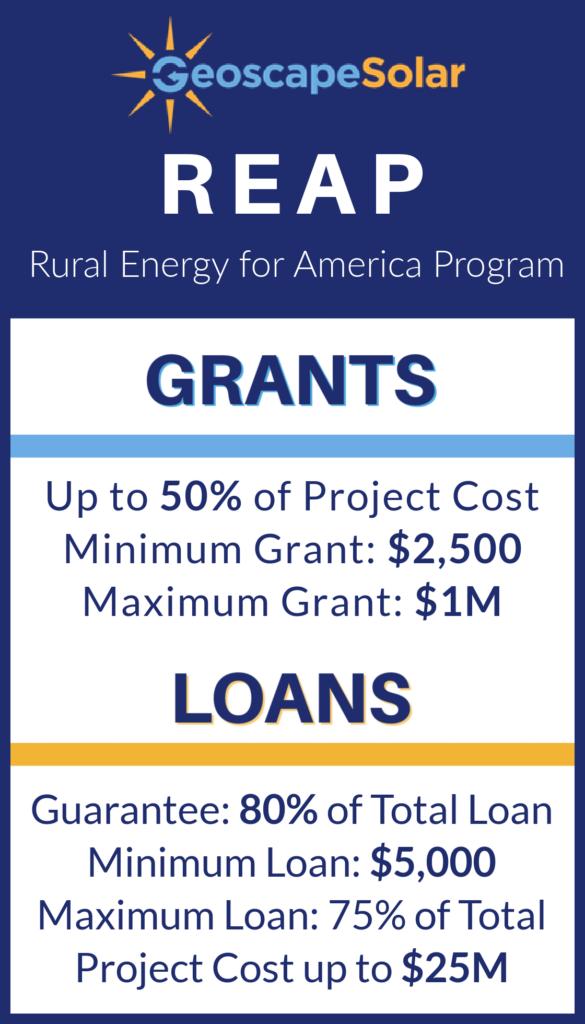

RURAL ENERGY FOR AMERICA PROGRAM (REAP) = UP TO 50%

Thanks to the Rural Energy for America Program (REAP) funding, rural businesses across all sectors, including agriculture, now have significant incentives. This funding is crucial for shielding these businesses from erratic utility rate increases which is conducive to increased monthly savings.

REAP extends its benefits to agricultural producers, with at least half of their revenue stemming from agricultural activities and small businesses located in areas with populations of 50,000 or fewer.

REAP extends its benefits to agricultural producers, with at least half of their revenue stemming from agricultural activities and small businesses located in areas with populations of 50,000 or fewer.

The REAP program offers both grants and loans that are awarded through an application process that has quarterly deadlines. REAP Grants can cover up to 50% of your commercial solar energy project costs. Grant awards range from $2,500 – $1,000,000. REAP loans range from $5,000 – $25,000,000 (75% of your commercial solar energy project costs). REAP loans guarantees 80% of the loan amount.

REAP grants and loan can financially empower rural businesses to install commercial solar energy solutions, operate sustainably, and bolster their bottom line.

Federal Modified Accelerated Cost Recovery System (MACRS) = UP TO 22% + State Modified Accelerated Cost Recovery System (MACRS) = UP TO 8% (COMBINED TOTAL UP TO 30%)

Accelerated depreciation is a tax strategy that allows farmers and agriculture growers the opportunity to recover the cost of their investments in a commercial solar energy system more quickly than through traditional depreciation methods.

In the context of commercial solar energy, accelerated depreciation works by allowing farmers and agriculture growers to write off a larger portion of the cost of their commercial solar energy system in the early years of its useful life. This means they can take larger tax deductions sooner, which can significantly reduce their tax liability and improve cash flow.

To compare:

-

-

- Traditional Depreciation: Normally, when a property owner purchases a capital asset like solar panels, they can only deduct a portion of the cost each year over the asset’s useful life, according to standard depreciation schedules set by tax authorities.

- Accelerated Depreciation: With accelerated depreciation, property owners can front-load these deductions, allowing them to deduct a larger portion of the system cost in the early years. This means they can get tax benefits sooner rather than spreading them out over many years.

-

Accelerated depreciation helps farmers and agriculture producers recoup their initial investment in solar energy more quickly, making an investment in solar energy more financially attractive and improves their Return on Investment (ROI).

Additional Incentives

Different states have different Commercial Solar Energy incentives. For example, New Jersey has Solar Renewable Energy Certificates (SRECs). When a commercial solar energy system produces electricity, it also generates SRECs. One SREC typically represents the generation of one megawatt-hour (MWh) of electricity from a solar energy system. Currently, New Jersey commercial SRECs pay the commercial system owner $110 each.

New Jersey also has Net Metering for commercial solar energy panel production. New Jersey’s net metering program allows property owners to sell their excess energy from their commercial solar panels back to their utility company in exchange for billing credits.

Combined, these incentives add up to a new revenue stream, a significant decrease in the upfront costs of installing commercial solar energy, and monthly savings that increase property owners’ bottom line.

Geoscape Solar specializes in commercial solar energy installation for farms, agriculture growers, and property owners. We are experts in qualifying property owners for the maximum amount of incentives, grants, and tax credits available. Contact us for a free solar assessment of your farm or take our 1 minute solar energy quiz to discover if your property is right for solar.